DESIBUZZCanada

Events Listings

Dummy Post

International Day Of Yoga To Be Virtually Celebrated Saturday At 4pm

CANCELLED: Coronavirus Fears Kills Surrey’s Vaisakhi Day Parade

ADVERTISE WITH US: DESIBUZZCanada Is The Most Read South Asian Publication Online

SURREY LIBRARIES: Get Technology Help At Surrey Libraries

WALLY OPPAL: Surrey Police Transition Update On Feb. 26

GONE ARE THE DAYS - Feature Documentary Trailer

Technology Help At Surrey Libraries

Birding Walks

Plea Poetry/short Story : Youth Contest

International Folk Dancing Drop-in Sessions

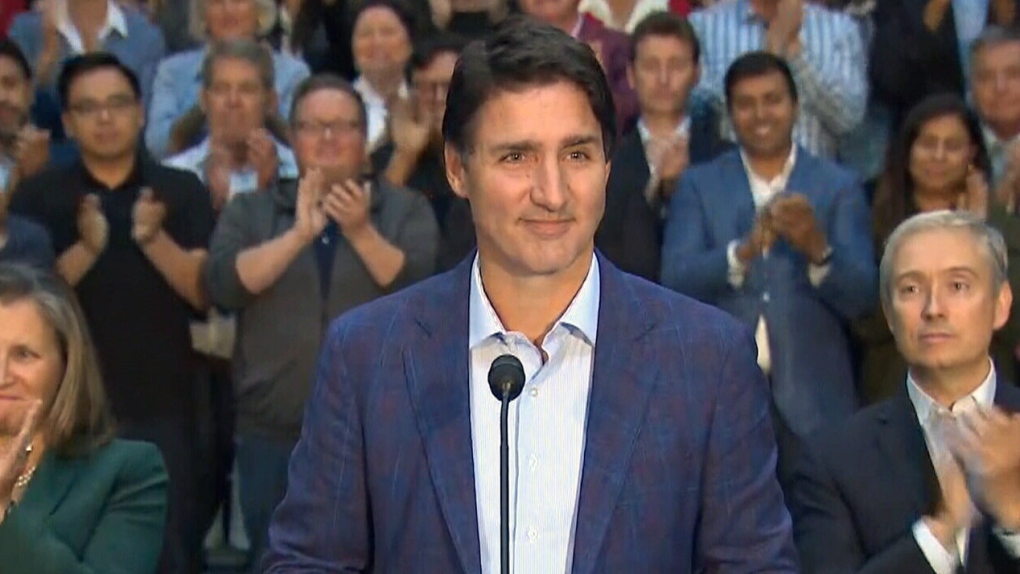

Trudeau Government Grants One Year CEBA Loan Extension

- September 15, 2023

The federal government granted a one-year Canada Emergency Business Account (CEBA) loan repayment extension Thursday, something which many businesses had been demanding given the onslaught of the recession and declining economy. The CEBA repayment deadline for the small business pandemic loan program was extended by Prime Minister Justin Trudeau for one more year. This loan was created as a result of the COVID-19 pandemic decimating small businesses.

By DESIBUZZCanada Staff

SURREY – The federal government granted a one-year Canada Emergency Business Account (CEBA) loan repayment extension Thursday, something which many businesses had been demanding given the onslaught of the recession and declining economy.

The CEBA repayment deadline for the small business pandemic loan program was extended by Prime Minister Justin Trudeau for one more year. This loan was created as a result of the COVID-19 pandemic decimating small businesses.

“While the Surrey Board of Trade appreciates the extension for businesses to repay the full loan amount if they missed the deadline to pay back the unforgivable portion, it is still an incredible burden on businesses,” said Anita Huberman, President & CEO of the Surrey Board of Trade. “We needed the Federal Government to reverse its decision and find an innovative pathway to give businesses flexibility to repay the unforgivable portion of the loan.

“Many businesses that used the loan are just starting to see returned growth but with Canada’s economy contracting, high inflation rates, high interest rates, and supply chain issues, it is not feasible to expect businesses to have the capital to repay the entire loan in a year’s time.”

The effects of higher interest rates will only begin to show on the economy after 12-18 months, and so we are yet to feel the true impact of rapid interest rate increases. Many economists are stating that further contraction of the economy will occur in the next few months. This contraction will make it harder for businesses to make the revenue necessary to repay the full loan.