DESIBUZZCanada

Events Listings

Dummy Post

International Day Of Yoga To Be Virtually Celebrated Saturday At 4pm

CANCELLED: Coronavirus Fears Kills Surrey’s Vaisakhi Day Parade

ADVERTISE WITH US: DESIBUZZCanada Is The Most Read South Asian Publication Online

SURREY LIBRARIES: Get Technology Help At Surrey Libraries

WALLY OPPAL: Surrey Police Transition Update On Feb. 26

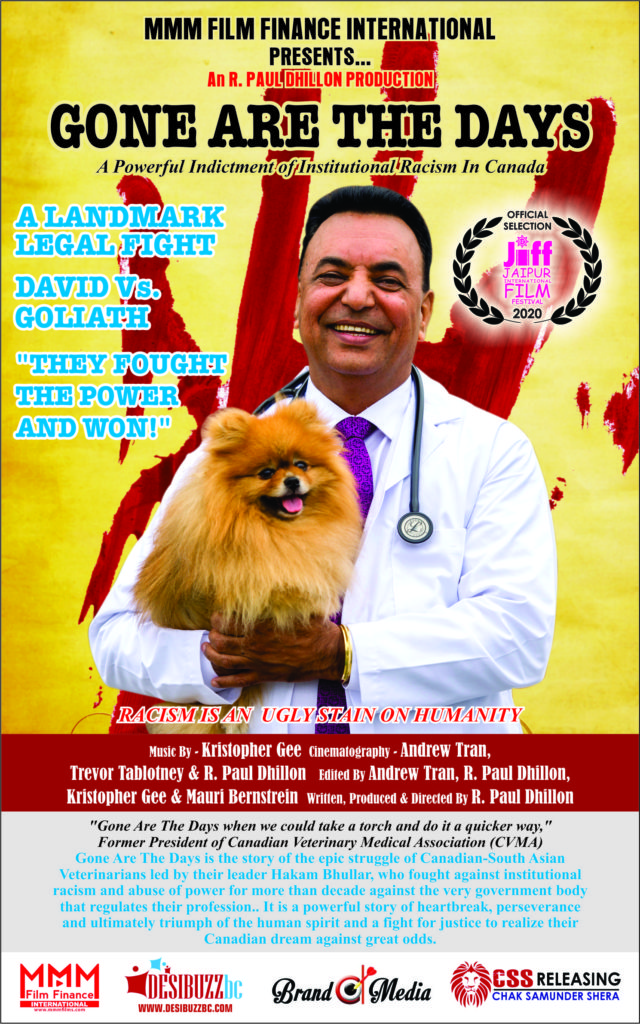

GONE ARE THE DAYS - Feature Documentary Trailer

Technology Help At Surrey Libraries

Birding Walks

Plea Poetry/short Story : Youth Contest

International Folk Dancing Drop-in Sessions

Trudeau Government Changing Stress Test Rate For Insured Mortgages

- February 18, 2020

The new minimum qualifying rate will be the greater of the borrower's contract rate or the weekly median five-year fixed insured mortgage rate from mortgage insurance applications, plus two percentage points.

OTTAWA – The Justin Trudeau government is changing the stress test rate for insured mortgages starting April 6.

The government says the change will allow the rate to be more representative of the mortgage rates offered by lenders and more responsive to market conditions, reported Canadian Press.

The new minimum qualifying rate will be the greater of the borrower's contract rate or the weekly median five-year fixed insured mortgage rate from mortgage insurance applications, plus two percentage points.

The stress test rate currently is the greater of the borrower's contract rate or the Bank of Canada five-year benchmark posted mortgage rate.

The Office of the Superintendent of Financial Institutions says it is also considering using the same new stress test rate for uninsured mortgages.

OSFI has been using a minimum qualifying rate of the greater of the contractual mortgage rate plus two percentage points or the five-year benchmark rate published by the Bank of Canada.