DESIBUZZCanada

Events Listings

Dummy Post

International Day Of Yoga To Be Virtually Celebrated Saturday At 4pm

CANCELLED: Coronavirus Fears Kills Surrey’s Vaisakhi Day Parade

ADVERTISE WITH US: DESIBUZZCanada Is The Most Read South Asian Publication Online

SURREY LIBRARIES: Get Technology Help At Surrey Libraries

WALLY OPPAL: Surrey Police Transition Update On Feb. 26

GONE ARE THE DAYS - Feature Documentary Trailer

Technology Help At Surrey Libraries

Birding Walks

Plea Poetry/short Story : Youth Contest

International Folk Dancing Drop-in Sessions

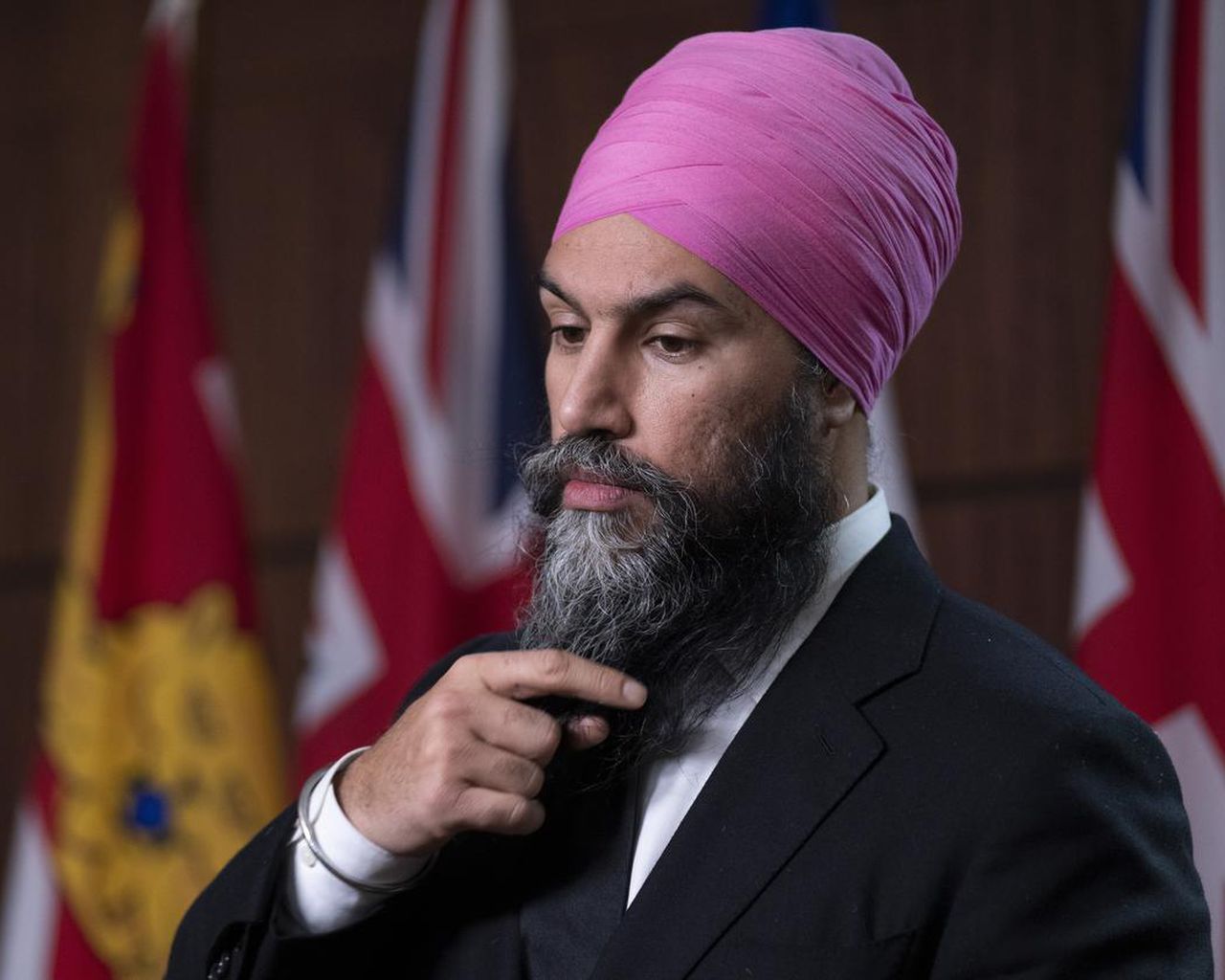

Jagmeet Singh Calls For CEBA Extension To Help Small Businesses Through Another interest Rate Hike

- July 12, 2023

On the echoes of business lobby groups and in light on the 10th straight interest rate hike Wednesday, NDP leader Jagmeet Singh called for the extension of CEBA loan repayments for businesses. In a move to help small businesses with their high expenses, federal NDP sent a letter to the Minister of Finance calling on her to extend the repayment deadline for the Canadian Emergency Business Account (CEBA) loans. “Small business owners across British Columbia, are doing everything right, but their money isn’t going as far as it used to. It’s putting a lot of businesses and workers in a tough situation,” said Canada’s NDP Leader Jagmeet Singh. “And with interest rates going up this situation is going to worse for local businesses who are trying to keep up with high rent and mortgages in Surrey. It’s times like this, that people want to see their government helping, not forcing small business owners to dig themselves into even deeper debt.”

By PD Raj – Senior Writer DESIBUZZCanada

SURREY –On the echoes of business lobby groups and in light on the 10th straight interest rate hike Wednesday, NDP leader Jagmeet Singh called for the extension of CEBA loan repayments for businesses.

The Bank of Canada raised interest rates once again, putting even more strain onto local businesses who are trying to keep up with their rent, mortgages and bills.

In a move to help small businesses with their high expenses, federal NDP sent a letter to the Minister of Finance calling on her to extend the repayment deadline for the Canadian Emergency Business Account (CEBA) loans.

“Small business owners across British Columbia, are doing everything right, but their money isn’t going as far as it used to. It’s putting a lot of businesses and workers in a tough situation,” said Canada’s NDP Leader Jagmeet Singh. “And with interest rates going up this situation is going to worse for local businesses who are trying to keep up with high rent and mortgages in Surrey. It’s times like this, that people want to see their government helping, not forcing small business owners to dig themselves into even deeper debt.”

CEBA needs to be repaid by the end of the year if owners are to still be eligible for a 33 per cent loan forgiveness of up to $20,000 and avoid five per cent interest on the outstanding loan. But, if forced to pay now, nearly 250,000 small businesses could be at risk of closing their doors. If the government forces small shops to pay CEBA now, almost half of the Canadian Federation of Independent Businesses’ members in British Columbia risk going out of business.

“It feels like Justin Trudeau isn’t worried about how inflation is hurting small businesses, because really inflation is only helping his rich friends make more money,” added Singh. “When rich CEOs are worried, Trudeau bails them out in a heartbeat, just like when he helped buy Loblaws freezers. Yet, he’s not doing the same thing for small businesses who are feeling the weight of inflation rate hikes.

If the government can help Loblaws cover their bills, the very least they can do for local stores and shops is give them an extra year to pay back CEBA. New Democrats are going to keep fighting to get small businesses the support they need, not just to keep the doors open, but to thrive.”