DESIBUZZCanada

Events Listings

Dummy Post

International Day Of Yoga To Be Virtually Celebrated Saturday At 4pm

CANCELLED: Coronavirus Fears Kills Surrey’s Vaisakhi Day Parade

ADVERTISE WITH US: DESIBUZZCanada Is The Most Read South Asian Publication Online

SURREY LIBRARIES: Get Technology Help At Surrey Libraries

WALLY OPPAL: Surrey Police Transition Update On Feb. 26

GONE ARE THE DAYS - Feature Documentary Trailer

Technology Help At Surrey Libraries

Birding Walks

Plea Poetry/short Story : Youth Contest

International Folk Dancing Drop-in Sessions

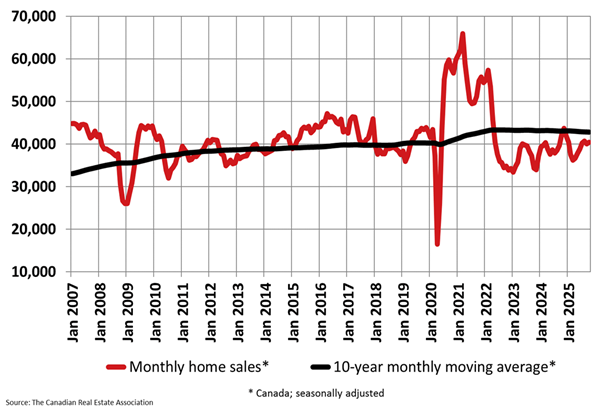

Canadian Home Sales Continue To Rise But Economic Uncertainty To Taper Momentum

- December 6, 2025

The number of home sales recorded over Canadian MLS Systems edged up 0.9% on a month-over-month basis in October 2025, marking six monthly gains in the last seven months. "After a brief pause in September, home sales across Canada picked back up again in October, rejoining the trend in place since April," said Shaun Cathcart, CREA's Senior Economist. "With interest rates now almost in stimulative territory, housing markets are expected to continue to become more active heading into 2026, although this is likely to be tempered by ongoing economic uncertainty." The MLS Home Price Index (HPI) edged up 0.2% month-over-month but was down 3% on a year-over-year basis. The actual (not seasonally adjusted) national average sale price was down 1.1% on a year-over-year basis.

By DESIBUZZCanada Staff

OTTAWA -- The number of home sales recorded over Canadian MLS Systems edged up 0.9% on a month-over-month basis in October 2025, marking six monthly gains in the last seven months.

"After a brief pause in September, home sales across Canada picked back up again in October, rejoining the trend in place since April," said Shaun Cathcart, CREA's Senior Economist. "With interest rates now almost in stimulative territory, housing markets are expected to continue to become more active heading into 2026, although this is likely to be tempered by ongoing economic uncertainty."

The MLS Home Price Index (HPI) edged up 0.2% month-over-month but was down 3% on a year-over-year basis.

The actual (not seasonally adjusted) national average sale price was down 1.1% on a year-over-year basis.

New supply declined 1.4% month-over-month in October. Combined with an increase in sales activity, the sales-to-new listings ratio tightened to 52.2% compared to 51% recorded in September. The long-term average for the national sales-to-new listings ratio is 54.9%, with readings roughly between 45% and 65% generally consistent with balanced housing market conditions.

There were 189,000 properties listed for sale on all Canadian MLS Systems at the end of October 2025, up 7.2% from a year earlier but very close to the long-term average for that time of the year.

"As we head into the quiet winter season, we continue to see clues that underlying demand for housing is picking up steam," said Valérie Paquin, CREA Chair. "All eyes will be on next year's spring market to see if all that pent-up demand will finally come off the sidelines in a big way. If you want to be a part of that 2026 market, contact a local REALTOR® and start planning today."

There were 4.4 months of inventory on a national basis at the end of October 2025, basically unchanged from July, August, and September and the lowest level since January. The long-term average for this measure of market balance is five months of inventory. Based on one standard deviation above and below that long-term average, a seller's market would be below 3.6 months and a buyer's market would be above 6.4 months.

The National Composite MLS Home Price Index (HPI) edged up 0.2% between September and October 2025. The non-seasonally adjusted National Composite MLS® HPI was down 3% compared to October 2024, the smallest year-over-year decline since March.

The non-seasonally adjusted national average home price was $690,195 in October 2025, down 1.1% from October 2024.