DESIBUZZCanada

Events Listings

Dummy Post

International Day Of Yoga To Be Virtually Celebrated Saturday At 4pm

CANCELLED: Coronavirus Fears Kills Surrey’s Vaisakhi Day Parade

ADVERTISE WITH US: DESIBUZZCanada Is The Most Read South Asian Publication Online

SURREY LIBRARIES: Get Technology Help At Surrey Libraries

WALLY OPPAL: Surrey Police Transition Update On Feb. 26

GONE ARE THE DAYS - Feature Documentary Trailer

Technology Help At Surrey Libraries

Birding Walks

Plea Poetry/short Story : Youth Contest

International Folk Dancing Drop-in Sessions

BC Government Says It’s Making ICBC More Accountable And Transparent While Opposition BC Liberals Say “Get Rid Of It”

- January 30, 2020

BC Liberal Leader Andrew Wilkinson said B.C. motorists have seen the average ICBC premium go up a whopping 18.2 per cent under the NDP, and ICBC projects a 24 per cent increase in premium prices over the next three years. But the NDP government blames Wilkinson and his BC Liberals for mismanaging ICBC and causing overload of debt while they were in power for which drivers have to ultimately have pay the high premiums. A key new change in ICBC under the government’s newly announced accountability changes, including setting up of a Fairness Office, will be to better support people who have been injured in a motor vehicle accident is pre-litigation payments. For those who are injured and qualify, ICBC will be offering pre-litigation payments up front without the need to waive the ability to sue if they so choose. Previously, if a person decided to take ICBC's settlement, they had to agree to not seek additional settlement money through the courts. The intent of this program is to help injured customers receive full and fair compensation as quickly as possible.

By DESIBUZZCanada Staff

VANCOUVER – While the BC Government says it is making changes to help ensure that ICBC is more transparent and accountable to its customers, the opposition BC Liberals say get it rid of the bureaucratic, bloated, non-competitive organization.

The government said this week that the purpose is to give British Columbians greater confidence that the corporation is treating them fairly when challenges arise, while better supporting people injured in crashes.

But BC Liberal Leader Andrew Wilkinson is renewing calls for choice in the auto insurance sector following the release of a new report that says British Columbians pay up to 42 per cent more for car insurance compared to drivers in Alberta.

"British Columbians are fed up with ICBC. We are paying the highest car insurance premiums in the country in the middle of an affordability crisis," said Wilkinson. "ICBC is no longer working for people and I'm a lot less worried about ICBC and more concerned with British Columbians being able to afford auto insurance."

The analysis of insurance rates done by MNP, one of the country's largest accounting firms, concluded that British Columbia and Alberta have similar insurance coverage and systems with the exception of Alberta allowing choice and free-market competition. A young driver commuting less than 15 kilometres to and from university in a 2008 Honda Civic would pay $828 less in Alberta than British Columbia for the same coverage.

"The reason we don't have choice in auto insurance is because the NDP has a love affair with government control, they think they know what's best for British Columbians," added Wilkinson. "David Eby and John Horgan need to start treating the people of this province with respect. Let's get an apples-to-apples comparison of the best insurance quotes for B.C drivers and let's pick the ones that provide the best rates that work for British Columbians."

Wilkinson said B.C. motorists have seen the average ICBC premium go up a whopping 18.2 per cent under the NDP, and ICBC projects a 24 per cent increase in premium prices over the next three years. But the NDP government blames Wilkinson and his BC Liberals for mismanaging ICBC and causing overload of debt while they were in power for which drivers have to ultimately have pay the high premiums.

The government said it will be taking steps to appoint a new Fairness Office - focused on customer fairness - that is more independent from ICBC. The office will be required to report out publicly, in plain language, on the type and number of issues it hears, along with recommendations to ICBC. ICBC will also be required to report publicly on actions it takes to respond to these recommendations.

"British Columbians should have the peace of mind that they will be treated fairly after they've been injured in a crash," said David Eby, Attorney General. "With this change, British Columbians can have confidence that the Fairness Office has greater independence from ICBC and has the impartial authority to review the fairness of their situation with the ability to make recommendations to ICBC."

The Fairness Office will be appointed by cabinet and be independent from ICBC's claims arm. This office will review and make recommendations to ICBC to resolve individual customer complaints, as well as policy and process, related to customer fairness. The new office will be in place by spring 2021.

The Fairness Office does not overlap with the role of the ombudsperson, who continues to have independent authority to resolve ICBC issues.

The Civil Resolution Tribunal (CRT) will continue to resolve disputes for ICBC claims of $50,000 and under, separate from the courts and independent of ICBC. When there is a disagreement between the customer and ICBC on certain decisions made by ICBC (e.g., matters involving minor injury determinations, accident benefit entitlement and fault determinations or claimed amounts $50,000 and under) the matter will be decided by the CRT, rather than the Fairness Office.

"Each of our three million customers should have confidence in knowing that they'll be treated fairly when they deal with us, and we welcome the Fairness Office to assist in that regard," said Nicolas Jimenez, president and CEO, ICBC. "British Columbians must also have the opportunity to tell us directly about how ICBC can be improved, and I believe today's changes will give our customers confidence in knowing that when they speak up, ICBC will be listening and accountable to them."

Additional reforms to improve how ICBC is accountable to its customers will include:

* a requirement to produce a customer-friendly summary of its annual report directly to its customers and in plain language, so that people can see how their premium dollars are spent;

* enhancing ICBC's existing customer panel to provide more British Columbians a greater opportunity to offer input on a wider range of topics, including future changes at the corporation; and

* improving online services for booking road tests.

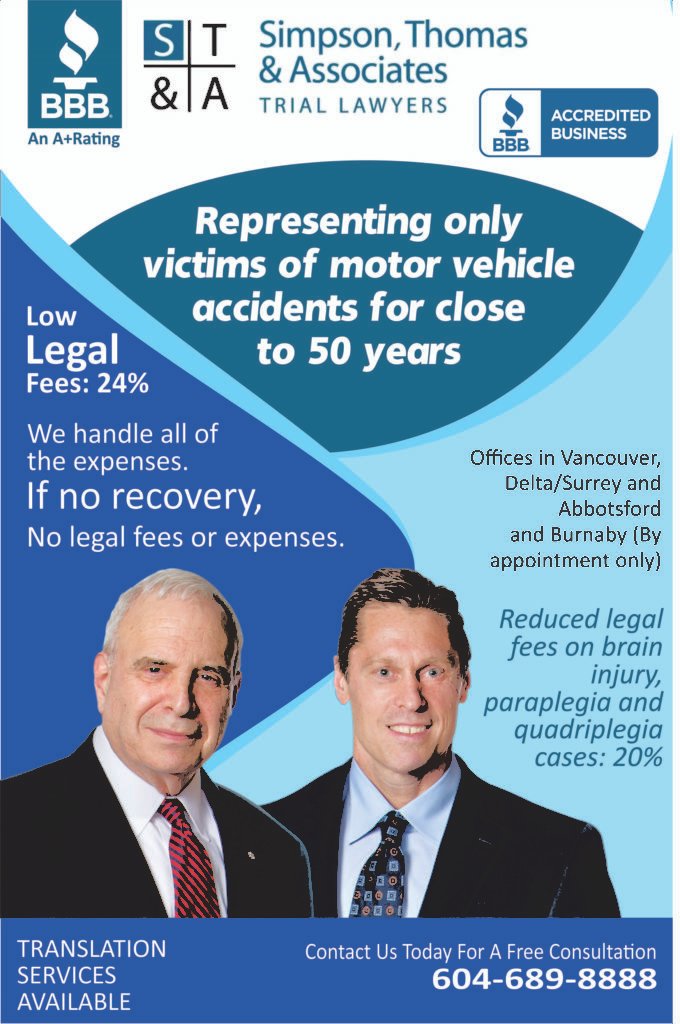

Another change that will be made by government to build trust and better support people who have been injured in a motor vehicle accident is pre-litigation payments. For those who are injured and qualify, ICBC will be offering pre-litigation payments up front without the need to waive the ability to sue if they so choose. Previously, if a person decided to take ICBC's settlement, they had to agree to not seek additional settlement money through the courts.

The intent of this program is to help injured customers receive full and fair compensation as quickly as possible. It will also help those injured keep more of their settlement, instead of paying it to lawyer and legal fees, which can total as much as 33% of the total settlement and can require a lengthy court process.

The ability for ICBC to offer pre-litigation payments will take effect as of Jan. 29, 2020, and will be formalized through legislation in spring 2020. The new Fairness Office will be formalized in legislation in fall 2020. Government will monitor all of the aforementioned changes to ensure ICBC continues to be accountable to its customers and all British Columbians.