DESIBUZZCanada

Events Listings

Dummy Post

International Day Of Yoga To Be Virtually Celebrated Saturday At 4pm

CANCELLED: Coronavirus Fears Kills Surrey’s Vaisakhi Day Parade

ADVERTISE WITH US: DESIBUZZCanada Is The Most Read South Asian Publication Online

SURREY LIBRARIES: Get Technology Help At Surrey Libraries

WALLY OPPAL: Surrey Police Transition Update On Feb. 26

GONE ARE THE DAYS - Feature Documentary Trailer

Technology Help At Surrey Libraries

Birding Walks

Plea Poetry/short Story : Youth Contest

International Folk Dancing Drop-in Sessions

BC Government Introduces New ICBC Law To Cut Expert Costs

- February 28, 2020

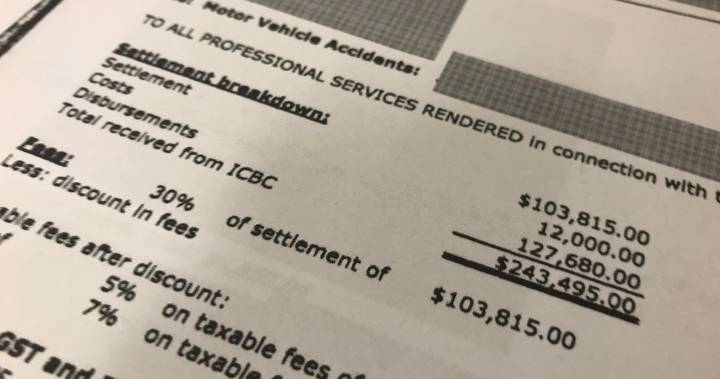

There will be a limit of one expert and expert report for each party for fast-track claims (e.g., claims under $100,000). A maximum of three experts and reports for each party will be set for all other claims. The parties can agree to use more experts without the need to file a formal application to the court. To demonstrate the government’s point, Global BC profiled a B.C. woman this week who received just $70,000 out of a $243,495 settlement from ICBC. Attorney General David Eby said a case like this would have cost the system not just the payout but all the legal costs picked up by ICBC as well. “It probably cost more than $350,000 to deliver $70,000 worth of benefits,” Eby said.

VICTORIA - Legislative amendments have been introduced that will reduce the cost and complexity of lawsuits under the current auto insurance system.

Proposed legislative amendments to the Evidence Act will limit the number of experts and expert reports that can be used in court on the issue of damages, while also providing judicial discretion to allow additional expert reports in appropriate cases.

There will be a limit of one expert and expert report for each party for fast-track claims (e.g., claims under $100,000). A maximum of three experts and reports for each party will be set for all other claims. The parties can agree to use more experts without the need to file a formal application to the court.

"With limits on the number of experts and expert reports, we are reducing the cost, complexity and delay associated with expensive duelling experts," said David Eby, Attorney General. "It means that claims will be resolved more efficiently."

Should the legislation be passed, proposed regulations would place a limit on the amount recoverable from the unsuccessful litigant for the cost of each expert report in motor vehicle personal injury cases to $3,000. Total recoverable disbursements in motor vehicle personal injury cases would also be limited to 5% of the judgment or settlement. Disbursements include all expenses incurred for the purpose of a lawsuit, such as courier fees, process servers and photocopying, but will not include fees payable to the Crown, such as filing, court and jury fees.

To demonstrate the government’s point, Global BC profiled a B.C. woman this week who received just $70,000 out of a $243,495 settlement from ICBC.

In an emotional interview, the woman told the Global News her injuries have cost more than $100,000 to deal with and that they have left her without the ability to work.

“It isn’t really sufficient enough for me to live,” she said. “Considering I cannot go back to work because I am not employable.”

Of the $243,495 payment from ICBC in the woman’s case, the legal fees were $164,759.85. Included in those fees were $84,778.07 in expert reports.

The Trial Lawyers Association of British Columbia turned down requests for an interview about the woman’s case and the issue of expert reports.

Eby said the woman’s case is a perfect example of what he describes as a “broken system.”

Eby said a case like this would have cost the system not just the payout but all the legal costs picked up by ICBC as well.

“It probably cost more than $350,000 to deliver $70,000 worth of benefits,” Eby said.

“Which is totally outrageous. I don’t blame the lawyers, it’s just so obvious the system is broken.”

Last year the province attempted to limit expert reports but the change, which was expected to save the province $400 million in this year’s budget, was defeated in court.

B.C. Supreme Court Chief Justice Christopher Hinkson ruled the B.C. government’s limits on expert reports were unconstitutional because they violated the powers of a court’s control over its processes.

But Eby says the new legislation addresses those concerns.

“The judge wanted to have discretion in unusual situations and I hope we have addressed that,” Eby said.

There are more than 90,000 active auto-insurance claims. There is potential for more claims to be brought forward between now and when ICBC's new insurance system, Enhanced Care coverage, takes effect May 1, 2021.

Quick Facts:

* Since 2017, the increased use of experts has contributed to a 30% increase in the cost of ICBC injury claims that are litigated.

* The limit on experts will not apply if the expert report was served before Feb. 6, 2020, or if a notice of trial was filed and served before Feb. 6, 2020, for a trial before Oct. 1, 2020.

* The proposed $3,000 limit to recoverable expert reports will not apply if the cost was incurred before Feb. 6, 2020, or if a notice of trial was filed and served before Feb. 6, 2020, for a trial before Oct. 1, 2020.

- The proposed 5% limit on disbursements will not apply if a notice of trial was filed and served before Feb. 6, 2020, for a trial before Oct.1, 2020.