DESIBUZZCanada

Events Listings

Dummy Post

International Day Of Yoga To Be Virtually Celebrated Saturday At 4pm

CANCELLED: Coronavirus Fears Kills Surrey’s Vaisakhi Day Parade

ADVERTISE WITH US: DESIBUZZCanada Is The Most Read South Asian Publication Online

SURREY LIBRARIES: Get Technology Help At Surrey Libraries

WALLY OPPAL: Surrey Police Transition Update On Feb. 26

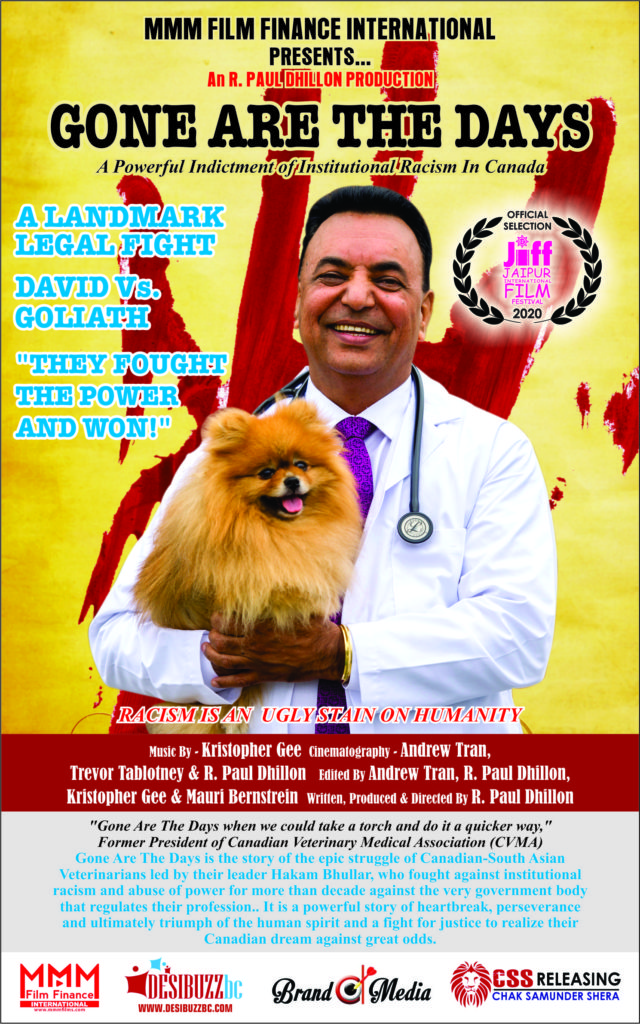

GONE ARE THE DAYS - Feature Documentary Trailer

Technology Help At Surrey Libraries

Birding Walks

Plea Poetry/short Story : Youth Contest

International Folk Dancing Drop-in Sessions

7th HIKE: Bank Of Canada Raises Another 50 Basis Points With Rates Highest Since 2008

- December 8, 2022

Home owners continue to be hammered by the Bank of Canada with another .5 percent hike even though the bank governor told Canadians that he saw low interest rates well into 2023. While the Bank of Canada signaled it might be ready to pause its aggressive rate hike cycle but the latest hike brings its key interest rate to 4.25 per cent - the highest it's been since January 2008 - and said its future rate decisions will be data-dependent, a major change from other announcements this year that have made clear the rate increases would continue.

OTTAWA – Home owners continue to be hammered by the Bank of Canada with another .5 percent hike even though the bank governor told Canadians that he saw low interest rates well into 2023.

While the Bank of Canada signaled it might be ready to pause its aggressive rate hike cycle but the latest hike brings its key interest rate to 4.25 per cent - the highest it's been since January 2008 - and said its future rate decisions will be data-dependent, a major change from other announcements this year that have made clear the rate increases would continue.

Since March, the central bank has raised its key interest rate seven consecutive times in an effort to bring inflation down and slow the economy.

“Looking ahead, 1/8 the 3/8 governing council will be considering whether the policy interest rate needs to rise further to bring supply and demand into balance and return inflation to target,” the Bank of Canada said in a news release.

That language is a marked departure from previous announcements where the bank said more rate hikes should be expected.

The Bank of Canada said there's “growing evidence” that higher interest rates are restraining demand in the economy.

Economic data released since its October interest rate decision supports its forecast that growth will stall through the end of the year and into the first half of 2023, the central bank went on to say.

At the same time, it said inflation is still too high and short-term inflation expectations remain elevated.

In October, the annual inflation rate was 6.9 per cent, well above the Bank of Canada's two per cent target. However, economists have noted the three-month annualized inflation rate has dropped to below four per cent, suggesting inflation is headed in the right direction.

Statistics Canada will release its November consumer price index report on Dec. 21, giving more insight on how inflation has evolved.

The Bank of Canada will announce its next interest rate decision on Jan. 25.