DESIBUZZCanada

Events Listings

International Day Of Yoga To Be Virtually Celebrated Saturday At 4pm

CANCELLED: Coronavirus Fears Kills Surrey’s Vaisakhi Day Parade

ADVERTISE WITH US: DESIBUZZCanada Is The Most Read South Asian Publication Online

SURREY LIBRARIES: Get Technology Help At Surrey Libraries

WALLY OPPAL: Surrey Police Transition Update On Feb. 26

GONE ARE THE DAYS - Feature Documentary Trailer

Technology Help At Surrey Libraries

Birding Walks

Plea Poetry/short Story : Youth Contest

International Folk Dancing Drop-in Sessions

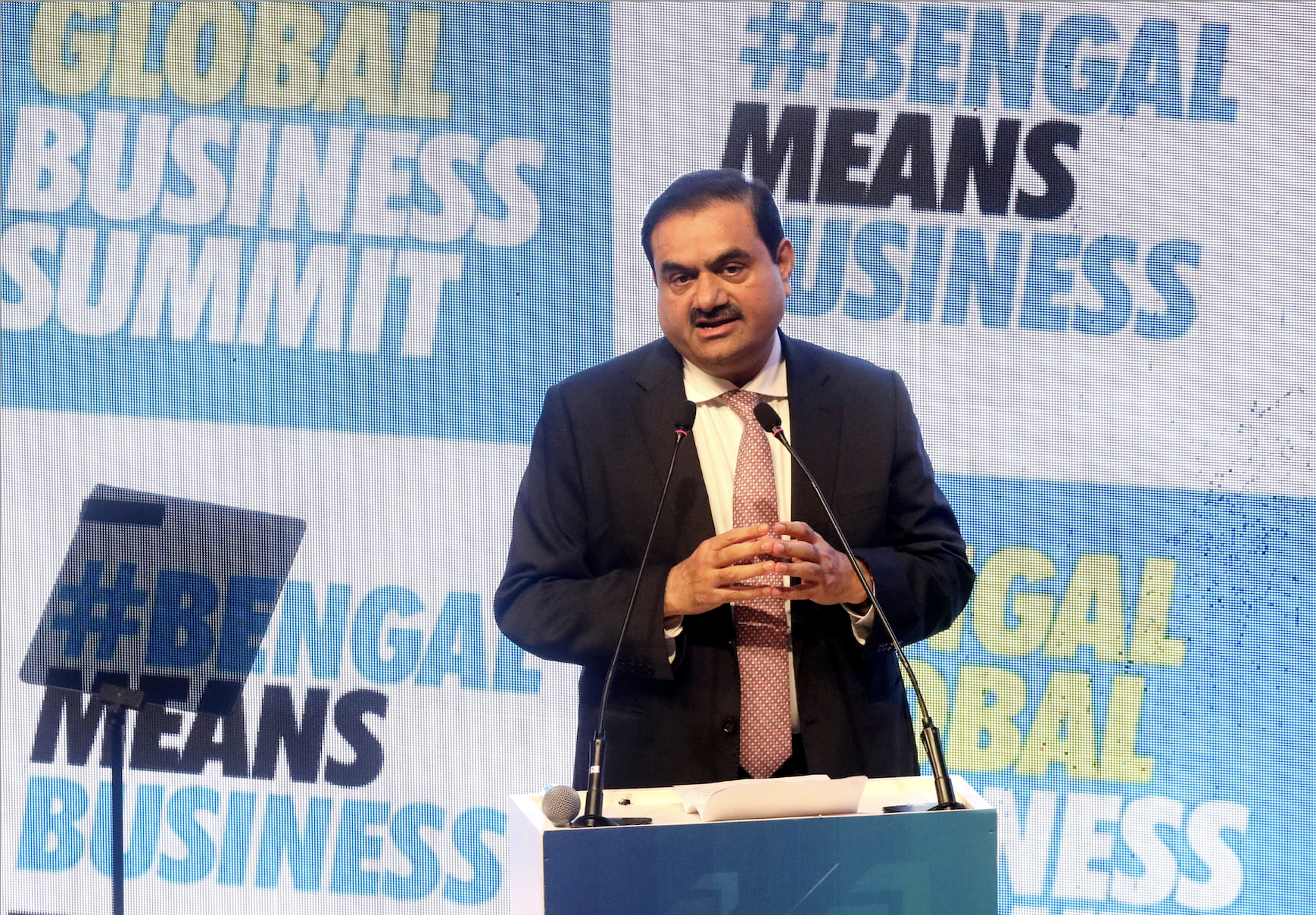

FREE FALL: Billionaire Adani’s Empire Crashes Following Accusations Of Fraud And Stock Manipulation

- February 2, 2023

Indian billionaire Gautam Adani’s empire is crashing by the billions following accusations of fraud and stock manipulation by US-based Hindenburg report. Adani Group shares were in freefall on Wednesday, when Union Budget 2023 was released, after global brokerage firm Credit Suisse assigned zero lending value to its bond. The global firm’s scrutiny of Adani Group bonds comes a day after Adani Enterprises’ follow-on public offer sailed through successfully due to the support from non-institutional investors. As of 3:00 PM on Wednesday, Adani Enterprises crashed 30 per cent, Adani Ports dropped 25 per cent, Ambuja Cements plunged 19 per cent, Adani Total Gas dropped 20 per cent, Adani Wilmar was down 5 per cent, ACC slumped 6.5 per cent and NDTV fell 5 per cent.

By DESIBUZZCanada Staff With News Files

NEW YORK – Indian billionaire Gautam Adani’s empire is crashing by the billions following accusations of fraud and stock manipulation by US-based Hindenburg report.

Adani Group shares were in freefall on Wednesday, when Union Budget 2023 was released, after global brokerage firm Credit Suisse assigned zero lending value to its bond. The global firm’s scrutiny of Adani Group bonds comes a day after Adani Enterprises’ follow-on public offer sailed through successfully due to the support from non-institutional investors.

As of 3:00 PM on Wednesday, Adani Enterprises crashed 30 per cent, Adani Ports dropped 25 per cent, Ambuja Cements plunged 19 per cent, Adani Total Gas dropped 20 per cent, Adani Wilmar was down 5 per cent, ACC slumped 6.5 per cent and NDTV fell 5 per cent.

Credit Suisse Group stopped accepting bonds of Adani group of companies as collateral for margin loans to its private banking clients, a sign that scrutiny of the Indian tycoon’s finances is growing after allegations of fraud by short seller Hindenburg Research, news agency Bloomberg reported.

Following the Hindenburg report that came out on 24 January, which accused the Adani Group of fraud and market manipulation, there were concerns in the market whether Adani Enterprises will attract investors’ attention in its FPO. However, the share sale went through successfully despite dismal participation across categories of retail investors and employees.

The investigative report prepared by Hindenburg Research last week had an immediate impact on the Adani stocks, dragging most of them down for five straight trading sessions. It is estimated that about a third of the Adani Group’s market capitalisation has been wiped out in the 5-day rout.

There are already mounting market concerns about Adani’s creditworthiness. With Evergrande’s crash fresh in investors’ minds, the Indian billionaire is in a risky place

: The bitter battle between the Adani Group and Hindenburg Research is heating up. In a rebuttal to Hindenburg’s claim that Indian tycoon Gautam Adani has overseen the “largest con in corporate history," the company took on a dramatic tone, calling the New York-based research outfit the “Madoffs of Manhattan." The activist short-seller’s report, Adani said, was a “calculated attack on India" and its “growth story and ambition."

Never mind that Hindenburg’s founder Nathan Anderson had worked with Harry Markopolos, the analyst who uncovered Bernie Madoff’s Ponzi scheme that robbed investors of as much as $65 billion. If anything, that puts Anderson in an anti-Madoff camp. Even as Hindenburg responded swiftly to Adani’s rebuttal, saying it failed to answer “62 of our 88 questions," it is nonetheless worth pondering what the short seller might focus on next to win over investors’ minds and money.

Despite its good reputation in New York’s finance circles, the Hindenburg name by no means translates into automatic success in Asia. Other conglomerates, such as China’s HNA Group and China Evergrande Group, had survived years of high-profile short sellers’ attacks and failed only when the political wind turned against them.

One of the research firm’s major allegations is stock manipulation. According to Hindenburg, Adani insiders already own more than 75% of four publicly traded subsidiaries with the aid of offshore shell entities, thereby triggering delisting according to India’s securities laws.

But that accusation alone is not enough to convince investors who are deciding what to do with their Adani holdings. For years, foreign investors had complained about Hong Kong-listed Evergrande’s limited free float and concentrated ownership, which made it difficult for them to short the developer’s shares — to little avail. Evergrande only became distressed when Beijing’s regulators cracked their whips, prompting domestic banks to stop lending to the builder.

As such, it will all depend on whether Hindenburg has enough global sway to shut down at least one of Adani’s key borrowing channels. Industrial companies are capital-intensive. If they can’t refinance, even good firms can go bad. Five of seven listed Adani companies have reported current ratios below 1, indicating they don’t have enough liquid assets to cover their short-term liabilities. That means Adani’s ability to refinance debt is all the more important.

On that front, Hindenburg might just have an outsized voice, in that about 30% of Adani’s borrowings are denominated in foreign currencies. The group has more than $10 billion dollar bonds outstanding, with an investor base including global asset managers such as Lord Abbett & Co., BlackRock Inc. and Goldman Sachs Group, according to Bloomberg data.

Already, a few dollar notes including debt of Adani Electricity Mumbai Ltd., a subsidiary with investment-grade rating, have fallen to distressed levels, indicating mounting market concerns about Adani’s creditworthiness. Hindenburg’s report is renewing a bond rout which began in September after Fitch Group unit CreditSights published a report raising concerns over the group’s leverage.

With Evergrande’s spectacular fall still recent in their memory, global bond traders can be jittery. For instance, Adani Ports & Special Economic Zone Ltd., the group’s biggest dollar-note issuer, is rated at BBB-, the lowest level of the investment grade. What if credit ratings agencies downgrade the company to junk, purely because of their belief that market selloffs can shut down financing options, as they’ve done to Chinese real estate developers? This fear alone could cause foreign bond buyers to flee.

It's been a very bad month for Indian billionaires — four of the richest Indians have collectively lost over $45 billion in 2023

A massive selloff in the listed companies of the Adani, India's richest man, is spilling over into the country's markets.

Adani Group's listed companies have lost more than $68 billion in market capitalization since Hindenburg Research, a US short seller, released a scathing report last Tuesday alleging "brazen stock manipulation and accounting fraud scheme" at the Adani Group. Adani Enterprises, the conglomerate's flagship, has lost over 25% in market value this year alone.

The rout has pummeled Adani's net worth, which is down $36.1 billion this year so far — propelling him into the spot of top loser on the Bloomberg Billionaires Index. The Indian industrialist has also fallen off the list of the top 10 wealthiest people and is now the world's 11th richest person — slipping from the fourth position just last week.

Adani is still the world's richest Asian, but his wealth wipeout shows the extent of losses in the Indian markets — which has spilled over to his fellow billionaires.

Trailing Adani on the Bloomberg Billionaires Index are fellow Indian billionaires Mukesh Ambani, Radhakishan Damani, and Savitri Jindal, who have lost about $5 billion, $2 billion, and $1 billion so far this year. Their net worth is down on the back of falling share prices in the companies they hold large stakes in.

Ambani is the chairman and majority shareholder of Reliance Industries, a conglomerate, while Damani is the founder of Avenue Supermarts. The stock of both companies have posted losses this year so far.

Share prices of most of Jindal's companies in her steel and power conglomerate are also down this year.

The drama surrounding the Adani Group has hit overall market sentiment in the South Asian market — India's benchmark index, the Sensex, is down over 2% so far this year.

"Allegations of fraud at one of India's most valuable conglomerates, the Adani Group, have hastened the decline we expected in Indian equities as foreign investors rebalance their portfolios on China's reopening," Shumita Deveshwar, the chief economist for India at macroeconomic consultancy TS Lombard, wrote in a Monday note seen by Insider.

Investors are bound to intensify their scrutiny of Indian stocks, Deveshwar added, but the country's corporate governance metrics rank better than most emerging markets including Saudi Arabia, China, and Brazil, according to a November 2022 report from TS Lombard.